Money Splitting Is Easier Now: The 5 Ultimate Cost-Splitting Apps

Money-splitting apps are divided up the cost of things such as purchase and group of people’s wants to buy anywhere so that everyone can pay their fair share. The best money-splitting apps also combine to a credit or debit card or another peer-to-peer payment platform, Money-splitting apps have made many times easier where you don’t have to apply your brains and use a calculator while figuring out how much money someone owes you and likewise. It is a fabulous idea to choose an app-based solution to make math as simple as possible.

Money-splitting apps

A money-splitting apps is an app you can install on your smartphone or tablet using the internet and using splitting bills. It divides the amount of the bill that is being split and assigns each person their cost down to the unit of currency. It helps you properly split the costs when going out with a group of friends and family.

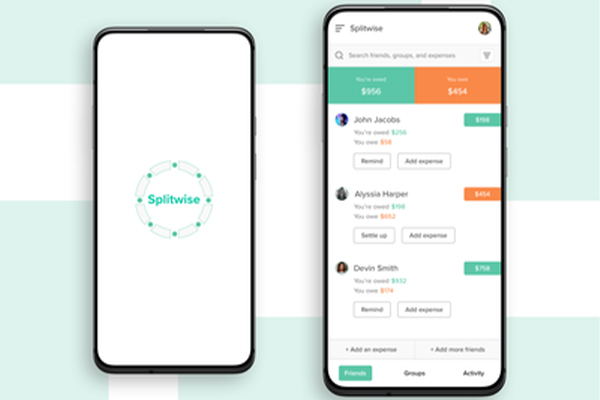

Splitwise

It catches the simple operation and plenty of features. It permits you to share any wizard expenses as well as label and save them. All expenses can be shared, from rent and travel to coffee and cake. It’s able to achieved to create multiple groups to track payments with everyone in your life, this free app, available for iPhone, Android, and the web is ideal if you’re frequently sharing payments with someone, whether it’s roommates, travel buddies, or your partner.

Splid

Splid is splitting up the cost of a group of members can be hardy. It permits you to add in all the payments of a trip and then split it up among each person on the trip. The app is user convenient for divide up non-expenses as well. Multiple payments can be added to each expense, the app works offline and includes features like total group spend, debt simplification, and currency conversion for more than one hundred and fifty currencies.

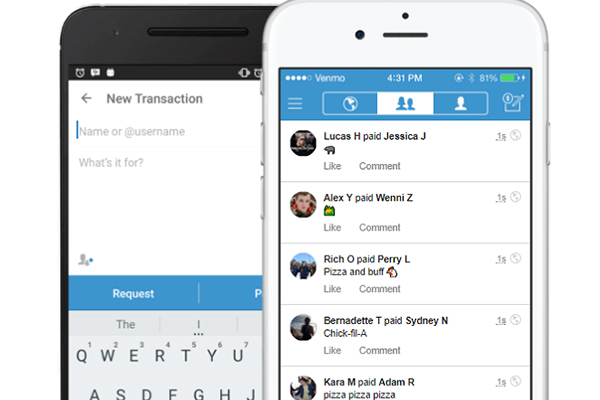

Venmo

Venmo permits you to divide a bill payment and pay your buddies immediately, and also requires some math on your end. When you are splitting down money using Venmo to send your half straight away, you can cut the inconvenient conversations. Then also send your friends a reminder if forget to pay a return. Unlike PayPal and google pay has no charges for sending or receiving money. It’s a well-known app in the States, mainly amongst those between 17-25. It feels like a social media platform as a personal finance tool with emojis & the function to “like and comment” on transactions.

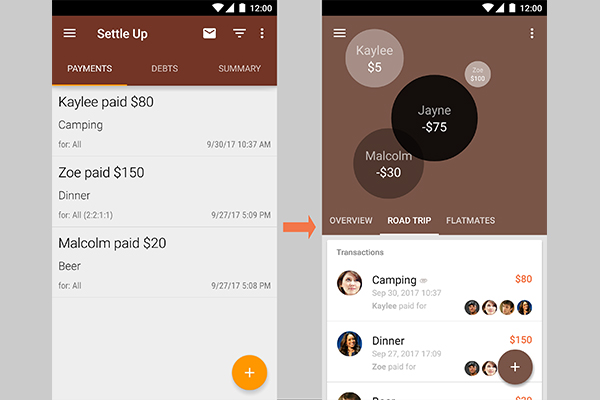

Settle up

The app is great because it supports different currencies and exchanges money and also recommends a broad range of add-ons. Keep using the money-splitting app to connect and costs, complete money transactions with another member. For those using Android, the basic version is ad-supported and costs 0.99/ month to eliminate ads and gain some more features. For iOS users, there’s no free version and a one -time payment of $1.99. Languages used in English, German, Danish, French, Greek, Italian, Catalan, Dutch, Polish, Portuguese, Swedish, Slovakian, Spanish, Czech, Hungarian, Vietnamese.

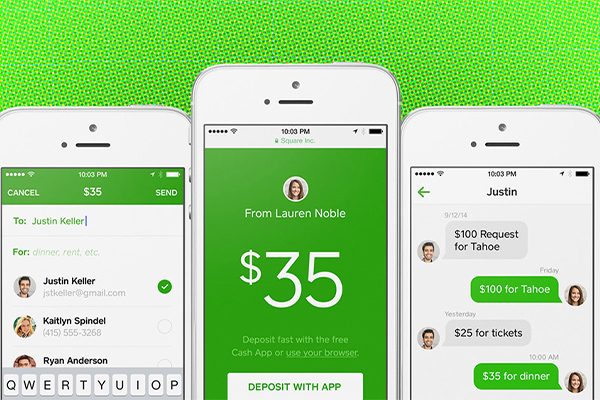

Square cash

Once you’ve determined how a payment should be split, you can send a payment request to each person in the group right through the app. They can open their Cash App and send prices based on your request. Then, as soon as you’ve been paid, you can “coins out” and get a deposit in your bank account or use your cash card (a digital debit card) to make purchases much like you will together along with your debit card. The app is free for sending money through a debit card. Credit card payments are charged a 3%and instant deposits to your checking account are charged 1.5% money.

Advantages of using money splitting apps

• Person-to-person payments using mobile apps, not intermediate bank protocols.

• Simple to access at any time, anywhere.

• You don’t have access to an ATM, debit card credit card, and so on. Only access through virtual id for varying applications.

• Less amount of time is spending.

• Cross-platform support.

• International money transfers with different currencies.

• No transfer limits.

Summary

Ultimately there are multiple ways to split costs among persons, but after testing a set of options, and never have the best-looking interface and irritating that you have to pay people back manually, but it’s free and serves the main purpose is extremely well. It can also set Tilts up so that everyone pays the same amount or a minimum amount and that no one gets charged until you established the goal. Once the event or gift is funded, the money is deposited into your account to proceed with paying for whatever you planned schedule.

Leave A Comment

You must be logged in to post a comment.